Entertainment

Could a Combined BMG & Concord Create a Fourth ‘Quiet’ Major Label? And More Questions Answered

With BMG’s parent company Bertelsmann in talks to acquire Concord in a deal that could be worth more than $6.6 billion, two of the largest indie music companies are primed to create what many are already calling the “fourth major” record label group, joining Universal Music Group (UMG), Sony Music Group (SMG) and Warner Music Group (WMG) at the table.

While any BMG-Concord merger would absolutely create a new, massive player in the industry, it wouldn’t necessarily stack up alongside UMG, SMG and WMG in the ways industry observers may expect. So, would BMG-Concord be a fourth major? What would being a “quiet” major actually mean? And how are we supposed to measure all these things, anyway?

Here’s an FAQ for those wondering what the ramifications of the BMG-Concord merger could be.

(In a statement sent to Billboard for this story, a BMG spokesperson said, “We’re aware of recent media speculation. As a policy, we do not comment on market rumors or unconfirmed reports.” Concord declined to comment.)

What Is A Major Label, Anyway?

Often, when discussing majors vs. indies, the definition hinges on market share: The majors have a lot of it; the indies, dispersed as they are, have a little of it individually. That’s often why indies band together via trade organizations like Merlin to negotiate deals with digital service providers — by operating collectively, indie labels have enough combined market share to have a seat at the table alongside the three existing behemoths and can negotiate on a similar playing field, at least theoretically. Consider that at the end of 2025, the U.S. overall market was divided up by Universal’s 38.96%, Sony’s 27.48% and Warner’s 18.87%; the indies, by distribution ownership, totaled 14.69%. (By label ownership, the indies traditionally hover around a collective 35%, though many indie labels use major-owned distribution — and distribution of bigger indie labels has become one of the characteristics that qualifies the majors as majors.)

So, Would BMG Be a Major?

BMG purchasing Concord would not, in a market share sense, materially change the above dynamic. BMG finished 2025 with an overall U.S. market share of 0.85%, while Concord came in at 1.81%. Combined, the two would make up just 2.66% overall market share in the U.S. — about the size of Sony’s fifth-largest division, Epic Records.

So, If Not Market Share, Then What?

But market share isn’t what this potential merger is about — nor is it what would define the combined companies’ place in the industry. Instead, the two could become a sort of “quiet major” — one that is exceptionally strong in publishing and catalog rights, with an estimated $2 billion in combined annual revenue, giving it the financial power to both compete on any catalog acquisition deal and beef up a frontline business that, for both, has shown potential in recent years.

BMG generated 963 million euros ($1 billion) in 2024, up from 663 million euros ($784.13 million) in 2021, which makes it among the fastest-growing independent music companies. (BMG is slated to report full-year 2025 revenues on March 26.) Concord is expected to generate less than BMG; though, with its recent acquisitions of STEM and the Broadway Licensing Group, as well as continued trajectory growth, it could also reach the $1 billion mark, if not in 2025 then by 2026, according to industry observers. That would put the two companies’ combined revenue in the neighborhood of $2 billion.

For comparison’s sake, for the full fiscal year of 2024 — the most recent year for which every company’s figures are available — WMG made $6.4 billion in revenue; Sony Music made 1.8 billion yen, or around $12 billion at the time; and UMG’s revenue was 11.8 billion euros, or around $12.8 billion at the time.

What About in Publishing?

BMG’s revenue in the past has been split, with about two-thirds coming from publishing and one-third from recorded masters. These days, however, thanks in part to its Broken Bow imprint, that percentage split is closer to 60%-40%, financial observers estimate. Meanwhile, Concord’s revenue was weighted in the opposite direction in the past, with its record labels generating about 55%-60% of its revenue, leaving publishing with 40%-45%. Calculating BMG’s and Concord’s percentages against their respective $1 billion estimated revenue numbers likely results in publishing coming in at 50%, or $1 billion. That would put them in the same ballpark as Warner Chappell, which had $1.3 billion in publishing revenue in its most recent fiscal year.

Wait, You Said “Quiet Major”? What Does That Mean?

On the record label side of things, the $2 billion in revenue may qualify a combined BMG and Concord as a major — but that’s where the term “quiet major” kicks in. Both companies were initially built as catalog operations. The re-animated BMG launched with publishing acquisitions in 2008. And, beginning in 2005, when Steve Smith took over Bicycle Music — one of Concord’s predecessor companies — that organization also initially focused on publishing acquisitions, though it also acquired Wind-Up Records before merging with Concord in 2015. Before that merger, Concord focused on acquiring catalogs, but it also liked the record labels side of the business, acquiring such well-known indie labels as Fantasy Records and Rounder Records.

For years, both companies were content to work catalog records, which bring in predictable revenue and steady profits, eschewing the riskier and costlier hit music marathon of front-line record labels. But in recent years that has changed, thanks to BMG’s ownership of Broken Bow Music — home to artists like Lainey Wilson and Jason Aldean, among others — and other frontline investments, while Concord has been the beneficiary of PULSE Records, which has produced hit music for both its publishing and record label side, most notably Tommy Richman’s Billboard Hot 100 No. 2 hit “Million Dollar Baby” two years ago.

Which is to say, the two companies have largely, and successfully, operated mostly in the background businesses of the music industry for the past two decades, quietly generating revenue and working closely with artists and songwriters in the trenches without really going toe to toe with the giants of the industry on the charts and in the mainstream hit-making conversation. But that doesn’t mean they wouldn’t have formidable clout to move more assertively into those areas in the future with their combined resources.

Still, if the merger happens, BMG and Concord will have an uphill battle if they want to compete on the frontline hit segment of the record label marketplace. On a unit basis, the combined BMG-Concord entity had 25.3 million consumption units in the U.S. in 2025, but its current unit count — releases within the past 18 months — only totaled 3.435 million units, meaning its current unit count is only 13.57% of the combined entity’s total. In the U.S. market, the three existing majors have current units at 20% or above, with WMG the lowest at 20.6% of its 179.34 million in total consumption units in 2025; Sony’s at 22.33% of its 261.13 million album consumption units; and UMG’s at 22.77% of its 370.27 million album consumption units last year in the U.S. (All Billboard calculations are based on Luminate data.)

How many artists do the companies have?

Concord supports more than 125,000 artists as of July 2025, according to a report published in July 2025 by rating agency KBRA for Concord’s most recent securitization. That information is not readily available for BMG.

How many songs would the companies have if they combined their portfolios of music catalogs? And how much might that be worth?

BMG owns more than 3 million musical compositions and around half a million sound recordings, according to a press release the company put out in 2024, while Concord has a catalog of some 1.3 million songs, according to the KBRA report. Combined, the two companies would have at least 4.3 million songs in their catalogs, which is significant but still trails the majors. Sony holds more than 6.3 million songs in its catalog, for example, according to its most recent quarterly filing.

Concord has used more than 1 million of its roughly 1.3 million music assets as collateral for asset-backed securities, and, in the rating report for its most recent issuance, that catalog of over 1 million music assets was estimated to be worth $5.117 billion, making the full value of its catalog higher than that total. Billboard was not able to determine the value of BMG’s catalog.

What Other Metrics Should I Know About?

Beyond revenue, the combined entity would have its fair share of hits, as the publishing side of the company would have 8.68% in Hot 100 market share for 2025, according to Billboard’s calculation based on Harry Fox-supplied publisher quarterly data. If nothing else, based on their track record — with BMG typically placing fifth and either Concord or its Pulse operation often placing in the second half of the top 10 publishing rankings for the Hot 100 — a combined BMG and Concord could consistently vie with Kobalt for the number four spot.

Who Are the Investors That BMG is Negotiating With? How Does That Compare to BMG’s Ownership?

Concord’s majority investor is the State of Michigan’s Retirement System, with Connecticut-based asset manager Great Mountain Partners as a minority investor. BMG’s majority owner is Bertelsmann, one of the oldest media companies in the world, which is still privately held by the founding Bertelsmann and Mohn families. Thomas Coesfeld, the BMG CEO who will become Bertelsmann’s CEO in 2027, is the grandson of Reinhard Mohn, who led the company from 1947. The Mohn family still owns 19% of Bertelsmann, while 80% of shares are controlled by foundations (Bertelsmann Stiftung, Reinhard Mohn Stiftung, BVG-Familienstiftung, BVG-Stiftung). Sources say that even with the merger, the Michigan Retirement System is not planning to fully cash out all of its holdings.

What About Distribution?

One other aspect of the combined entity’s status would be its distribution pipeline. Currently, Concord is distributed by UMG. BMG, meanwhile, recently unwound itself from its longstanding association with Warner Music’s ADA and struck direct deals with the digital service providers while partnering with UMG for physical distribution. If the two were to properly become a fourth major, that association with UMG would presumably have to be severed. If the combined entity decides to go down that path, Concord may already have the building blocks in its back pocket thanks to its 2025 acquisition of Stem Distribution.

Does the combined entity need its own distribution arm to be considered a major? Some would say yes. But distribution these days is more about systems than it is people in the field or on the phones. Keeping track of the billions of transactions and mining them for opportunity is one of the main attributes offered by the majors. As it is, BMG is going direct with the big digital service providers like Spotify, Apple and Amazon, while leaving the smaller DSPs to be handled by UMG, although, if Luminate market share is any indicator, some DSPs are still handled by BMG.

What Other Dominos Could Fall?

Sources suggest that the current talks represent the second or third time in the last 10 years that BMG and Concord have considered merging, although this time the talks are much further along and appear more likely to happen. That means more things could happen in the marketplace that could shore up any combined entity and make it more able to compete with giant competitors.

Could that mean purchasing another distribution company? It’s possible — over the past half-decade, dozens of distribution companies have cropped up as entrepreneurs, and label veterans have raced to offer services companies to cater to the growing middle class of creators enabled by digital music. That has also led to consolidation: UMG has a major pending deal to buy Downtown Music and recently acquired [PIAS], while Sony purchased AWAL and Warner has long been rumored to be seeking distribution acquisition targets. A combined BMG and Concord could also look to that sector to bolster its offerings and its own distribution pipeline.

There are also other acquisition targets on the market, including tech companies, publishers, and digital solutions and marketing firms. However, one rumor that has been making the rounds — that Kobalt is in their sights — seems far-fetched, as Kobalt sold off all of its catalog and distribution arm and is now mainly a publishing administration platform, albeit a very successful one.

The merger would, however, be brutal on the combined entity’s headcount. Sources suggest that BMG has about 900 employees and Concord has about 800 — and industry observers speculate that if the two companies strike a deal, massive layoffs are likely to follow. As one financial source puts it, “The more they slash, the more profitable it will become.”

Entertainment

‘Dawson’s Creek’ Star James Van Der Beek Dead at 48 After Cancer Battle

James Van Der Beek, who was known for portraying Dawson Leery in 1990s teen drama Dawson’s Creek, died at 48 on Wednesday (Feb. 11) after a battle with cancer, his family announced.

“Our beloved James David Van Der Beek passed peacefully this morning. He met his final days with courage, faith, and grace,” the statement, posted to Instgram, read. “There is much to share regarding his wishes, love for humanity and the sacredness of time. Those days will come. For now we ask for peaceful privacy as we grieve our loving husband, father, son, brother, and friend.”

The actor revealed in an exclusive interview with People in November 2024, that he had stage 3 colorectal cancer; he was 46 at the time. Van Der Beek told the magazine that his family had no history of cancer, and that he was careful to take good care of his health. “I’d always associated cancer with age and with unhealthy, sedentary lifestyles,” he told People. “But I was in amazing cardiovascular shape. I tried to eat healthy — or as far as I knew it at the time.”

He said that he first noticed changes with his bowel movements in 2023, but assumed it was diet related, but decided to be safe and get a colonoscopy. That’s when he learned he had colorectal cancer. Despite the diagnosis, Van Der Beek said he was “cautiously optimistic at the time,” telling People, “I have a lot to live for.”

Throughout his treatment, the actor shared his story, repeating in interviews that he hoped his tale would encourage others to talk to their doctors and get tested.

In addition to Dawson’s Creek, the actor also starred in films such as Varsity Blues and The Rules of Attraction, and also had memorable guest roles on shows including Law & Order: Special Victims Unit, One Tree Hill and Ugly Betty.

Van Der Beek also had a memorable starring role in Kesha’s 2011 video for “Blow.” In the visual, the actor and musician eye each other across a dance floor, then bust out laser guns and start shooting (taking out a few unicorns in the process), before Kesha reigns victorious.

James Van Der Beek is survived by his wife, Kimberly, and their kids Olivia, Joshua, Annabel, Emilia, Gwen and Jeremiah.

See the family’s announcement of his passing below:

Entertainment

European Commission Set to Approve UMG’s Downtown Deal This Week: Report

The European Union is expected to approve Universal Music Group’s $775 million acquisition of Downtown Music Holdings as soon as this week, following a remedy UMG submitted in December that it says addresses regulators’ concerns over its access to commercially sensitive data.

The European Commission’s probe, launched last year, centered on concerns that the deal would reduce competition by giving UMG access to sensitive data from rival labels through Downtown’s Curve royalty accounting and rights management business, as well as its artist and label services.

The Financial Times first reported on Wednesday (Feb. 11) that the European Commission (EC) is planning to approve the deal this week, and sources say the plan UMG submitted in December included conditional commitments to spin off these divisions of Downtown.

UMG and Virgin Music Group, which would oversee the acquired entity, declined to comment. Representatives from the European Commission did not immediately respond to a request for comment.

Trade groups representing the independent side of the music industry in Europe say that, regardless of the outcome, they see a win in the European Commission’s lengthy two-phase investigation of the acquisition and the remedies it was able to secure from UMG.

“Entities planning consolidation need to expect full scrutiny and regulator appetite to make full use of what they have in their toolkit,” Martin Mills, founder and chair of Beggars Group, said through a statement provided by IMPALA. “The unprecedented speaking out we have seen in the independent sector sends a clear message that the concerns are real. A level playing field is in the interests of all.”

Founded as a music publisher in 2007, Downtown has grown into a major provider of distribution, royalty accounting and rights-management services to record labels and artists. In addition to Curve, it owns the distribution services FUGA and CD Baby and the publishing administration provider Songtrust.

UMG, the world’s largest music company, announced in December 2024 that its Virgin Music Group would buy Downtown to position Virgin to provide labels and artists with a “global end-to-end solution” for client services and technology.

The move sparked fears of UMG dominance over one of the few remaining large distribution companies for independents. In July, a group of more than 200 executives and others from the independent music industry said the deal would give UMG too much power over the basic logistics of the modern music business.

“A concentration of this magnitude would narrow the range of voices, styles and cultures that reach the public,” the letter read. “It would give UMG further power to shape digital services, influence monetization thresholds and extract more, at the expense of the independent sector.”

UMG and Virgin have said that acquiring Downtown’s suite of companies does not dramatically reduce the options in independent services. The market remains so fragmented, they say, that even with Downtown, Virgin would rank behind Sony’s The Orchard and Believe in terms of market share.

Virgin’s executives have called concerns over proprietary data of competing companies overblown.

“Virgin already handles — with the care and confidentiality they deserve — the sensitive client data of hundreds of partners,” Virgin’s co-CEOs Nat Pastor and JT Meyers wrote in an internal memo reported by Billboard last year. “Betraying the trust our clients have bestowed on us would be self-destructive: they would quickly, and quite rightly, end the relationship.”

Entertainment

Sonic Editions Just Dropped a Set of Gift-Worthy Tupac Shakur Prints That Capture Hip-Hop History

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

Tupac Shakur, to many, is synonymous with the words “rap excellence,” no more, no less.

Sonic Editions is aiming to capture that excellence in a print set launched in celebration of the rapper’s 1996 album, All Eyez on Me, his last album before passing in a drive-by shooting in Las Vegas. The photo set dropped by Sonic Editions captures important moments and figures in hip-hop history from the 1990s. Viewers are treated to appearances from big names like Nas, Redman, and Chuck D snapped alongside Shakur while in New York or Chicago. Our chosen prints were captured by the likes of Al Pereira and Raymond Boyd, the two main contributors for photos in this drop. Every print is available on Sonic Editions’ website.

Prints of each scene can be found in black and white or in color, and begin at $99. Sizing and framing of your chosen print determine pricing. Sizing goes up to XXL. Every framed print is glazed with crystal-clear, gallery-grade shatterproof plexiglass for premium protection and printed on archival-grade Fuji Crystal Archive paper for depth and color accuracy. These prints are also mounted with acid-free, conservation-grade materials that ensure longevity.

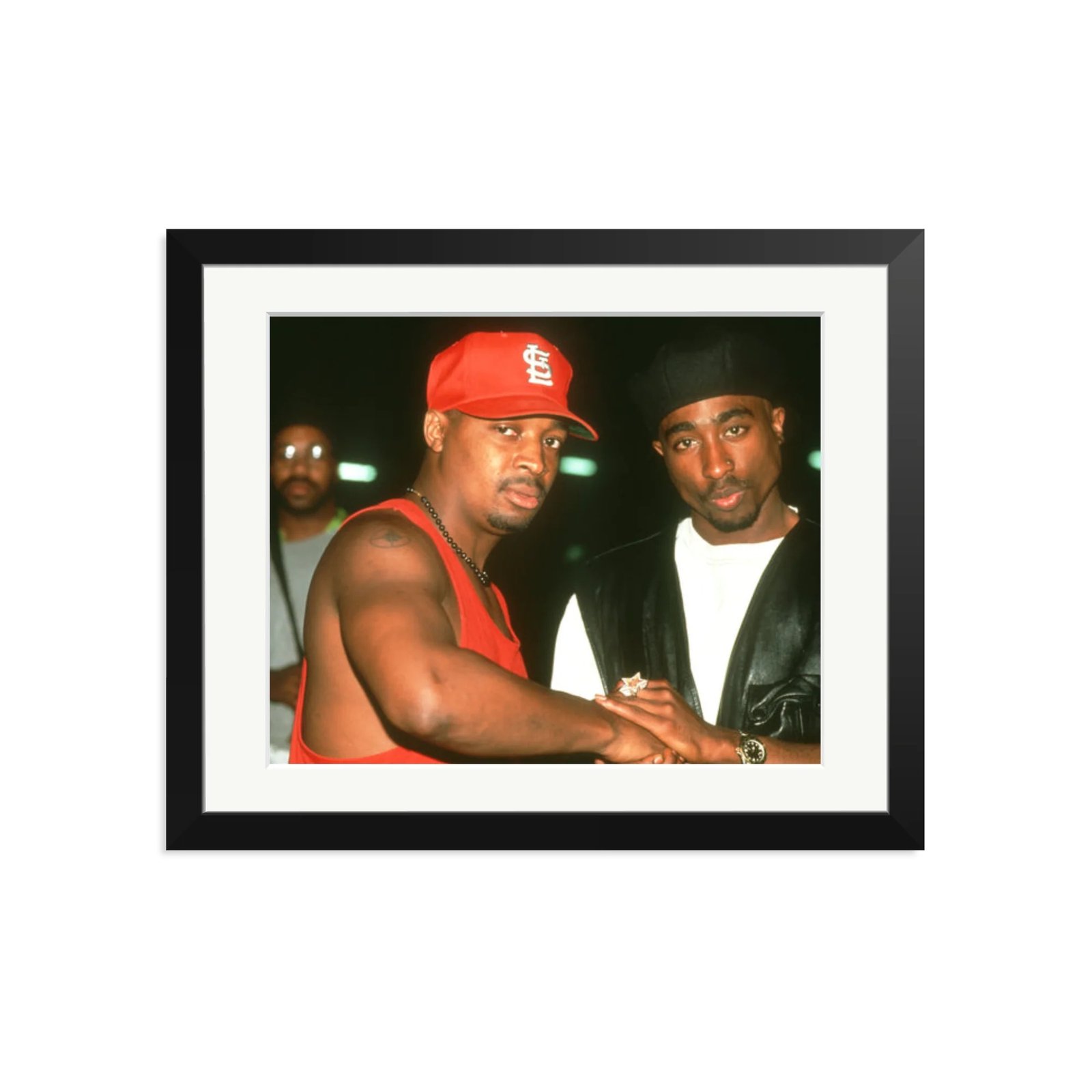

Nas, Tupac & Redman 1993 by Al Pereira

This photo depicts rappers Nas, Shakur and Redman dated July 23, 1993, at Club Amazon in New York. Not pictured was fellow rapper The Notorious B.I.G., who famously beefed with Shakur. This image captures a moment of peace and unity among the rappers before their East Coast-West Coast rivalry began.

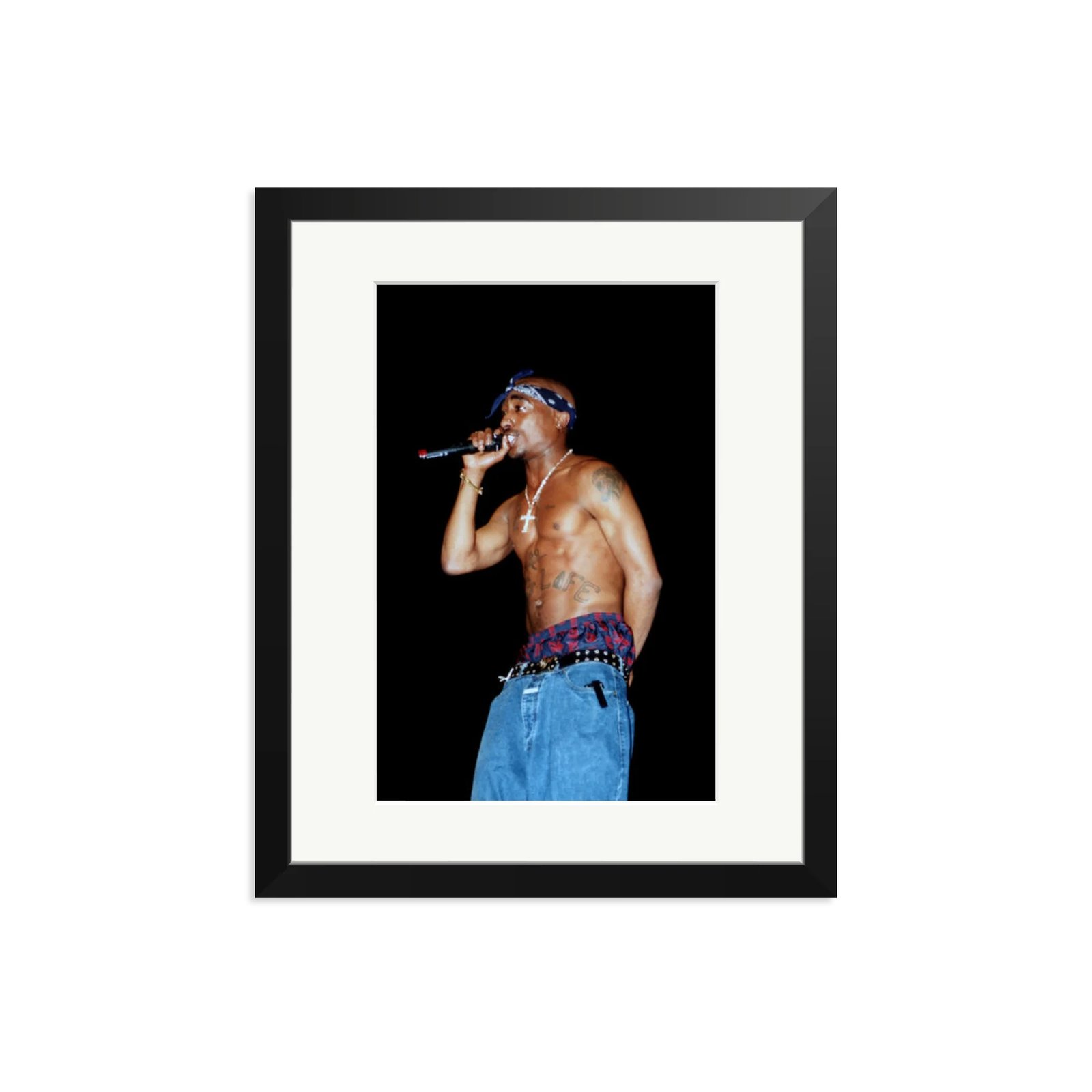

2 Pac in Chicago by Raymond Boyd

This print is a photo taken at the Regal Theatre in Chicago in 1994. This performance photo was taken while Shakur was still a part of the group consisting of Big Syke, Mopreme, Macadoshis and The Rated R. Shakur would leave the group around 1995. This print captured a moment of the rapper’s iconic and short-lived career.

One of the unique sets of photos in this print set is those taken at Club Amazon in New York on July 23, 1993. The set features appearances from rappers mentioned above along with The Notorious B.I.G., who wasn’t in these prints. This freeze-frame captures peace, a point in time before Shakur and B.I.G.’s infamous East Coast-West Coast rivalry began.

This 1990s rivalry was birthed from a battle of cultural dominance and a hunger for success, primarily between Bad Boy Records, owned by Sean “Puffy” Combs, a New York-based label, and Death Row Records, a Los Angeles-based label. Shakur was signed to Death Row in 1995, while Biggie was signed with Bad Boy in 1993, cultivating a natural beef that was often violent and ugly.

Shakur has more than five No. 1 albums on the Billboard 200 and eight No. 1 albums on the Top R&B/Hip-Hop Albums chart. All Eyez on Me landed on the Billboard 200 and included hits such as “California Love” and “How Do U Want It.” Shakur died in a drive-by shooting shortly after the launch of All Eyez on Me in 1996. Skaur’s death was a direct consequence of the violent East Coast-West Coast feud. The Notorious B.I.G. would also fall victim to the beef, dying a year later in 1997.

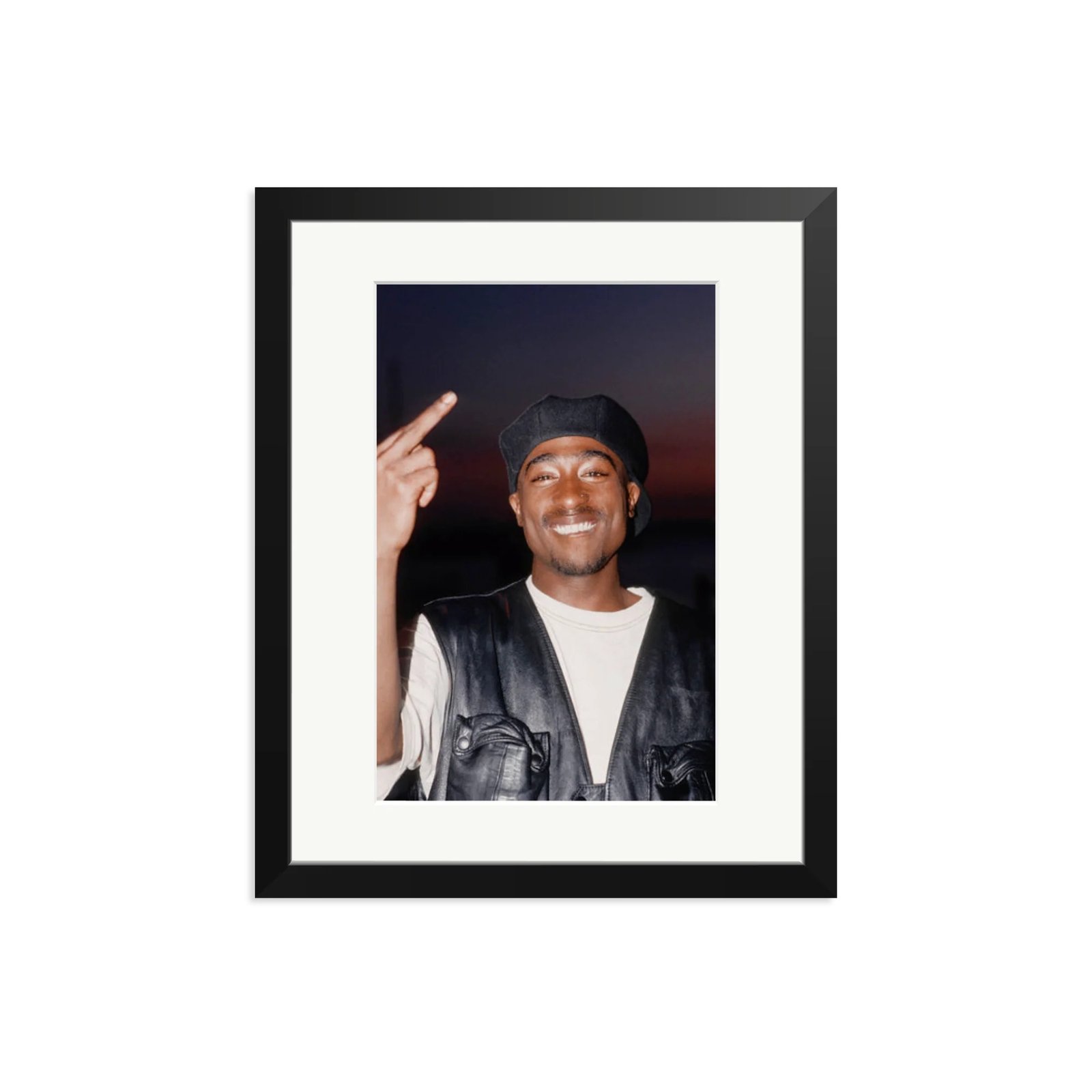

Tupac Shakur & Chuck D by Al Pereira

Rapper Chuck D served as a mentor to Shakur throughout his life and is seen here in a July 23, 1993, print of the pair in New York backstage at one of Shakur’s shows. After Shakur’s death, Chuck D participated in a 2015 Grammy Museum exhibit nodding to Shakur’s 1996 album with a title “All Eyez on Me: The Writings of Tupac Shakur.”

Tupac at Club Amazon by by Al Pereira

Shakur graced Club Amazon on July 23, 1993, in New York. His appearance at the club was a pivotal moment in hip-hop history, capturing a snapshot of the era before the notorious East Coast-West Coast beef.

-

Tech2 weeks ago

Tech2 weeks agoSend Help review: GLOP! Youre not ready for Rachel McAdams latest… but I love it

-

Business5 months ago

How I Paid Off My Mortgage 10 Years Early On A Teacher’s Salary

-

Politics5 months ago

Politics5 months agoBlack Lives Matter Activist in Boston Pleads Guilty to Federal Fraud Charges – Scammed Donors to Fund Her Lifestyle

-

Tech5 months ago

Tech5 months agoGet a lifetime subscription to the “ChatGPT for investors” for under $60

-

Tech5 months ago

Tech5 months agoReview: The Dreame H15 Pro CarpetFlex is the first wet/dry vacuum I liked

-

Business5 months ago

25 Low-Effort Side Hustles You Can Start This Weekend

-

Business5 months ago

9 Ways to Command a Six-Figure Salary Without a Bachelor’s

-

Entertainment4 months ago

Entertainment4 months agoFat Joe Recalls Bruno Mars Snapping on Him Over Question About Puerto Rican Roots: ‘Broke My Heart’